To expedite and streamline tax collection, the income tax agency implemented the TDS tax deduction system. Any HUF or individual buying real estate for at least Rs. 50 lakh is required by the Finance Act of 2013 to deduct TDS from the seller’s payment. There is a deadline for submitting Form 26QB to the government in order to pay this TDS amount.

We have covered every aspect of online Form 26QB in this article. Continue reading by scrolling down.

What Is Form 26QB?

The Income Tax Act of 1961 has set specific rules for purchasing and selling immovable property. Under Section 194-IA of the income tax, a buyer should deduct TDS at 1% of the sum or the stamp duty value of such property, whichever is higher, only if the property value for transactions exceeds Rs.50 lakh.

ITR Filing Last Date 2024

The last date to file Income Tax Return (ITR) for FY 2023-24 (AY 2024-25) without a late fee is 31st July 2024.

For example, if a buyer pays Rs. 90 lakh for a property, the TDS deduction will be started on the value of the property (i.e., Rs. 90 lakhs) rather than Rs. 40 lakh (90-50).

The online statement/challan form 26QB is used to pay the government this TDS. In order to make a TDS payment on the sale of a property, the buyer must complete this form within the allotted period. All of the property’s information is needed on this form, as well as information about buyers, sellers, tax deposits, and other things. The Income Tax website has it available.

When Should Form 26QB Be Filed?

If you are a buyer, then you must file and submit Form 26QB within 30 days from the month’s end for which the tax was deducted. For a comprehensive understanding, let’s consider an example:

Suppose you buy a property from a friend, and the transaction was initiated on 15 December 2023. In this case, you must submit the TDS amount on or before 30 January 2024. If you fail to file the return within the stipulated due date, a late fee of Rs.200 per day will be imposed.

Avoid last-minute chaos. Use code INDTAX30 IN FORM and get 30% OFF on ITR, GST & more.

Home- >

- Income Tax

- >

- How To Download And Fill Form 26QB For TDS Payment On Purchase/Sale Of Property?

SHARE

How To Download And Fill Form 26QB For TDS Payment On Purchase/Sale Of Property?

|

Updated on: Apr 21st, 2025

|

3 min read

The income tax department introduced the TDS tax deduction system to collect taxes quickly and conveniently. As per the Finance Act, 2013, any HUF or individual purchasing real estate worth at least Rs. 50 lakh must deduct TDS when paying the seller. This TDS amount must be paid to the government by filing Form 26QB within a specific time frame.

In this article, we have explored everything related to online Form 26QB. Scroll down and read further.

What Is Form 26QB?

The Income Tax Act of 1961 has set specific rules for purchasing and selling immovable property. Under Section 194-IA of the income tax, a buyer should deduct TDS at 1% of the sum or the stamp duty value of such property, whichever is higher, only if the property value for transactions exceeds Rs.50 lakh.

ITR Filing Last Date 2024

The last date to file Income Tax Return (ITR) for FY 2023-24 (AY 2024-25) without a late fee is 31st July 2024.

For instance, if a buyer purchases a property for Rs.90 lakh, then the TDS deduction will be initiated on the property’s value (i.e., 90 lakhs) and not on Rs.40 lakh (90-50).

26QB is an online statement cum challan form used for the payment of this TDS to the government. The buyer must fill out this form within a stipulated time for making a TDS payment on the sale of a property. This form requires all details of the property along with the details of buyers, sellers, tax deposits, and so on. It is available on the Income Tax website.

When Should Form 26QB Be Filed?

If you are a buyer, then you must file and submit Form 26QB within 30 days from the month’s end for which the tax was deducted. For a comprehensive understanding, let’s consider an example:

Suppose you buy a property from a friend, and the transaction was initiated on 15 December 2023. In this case, you must submit the TDS amount on or before 30 January 2024. If you fail to file the return within the stipulated due date, a late fee of Rs.200 per day will be imposed.

Hire Your Tax Expert In Advance!

Avoid the rush and file hassle-free when tax season hits | USE NOTARIFF30 and get 30% OFF!

Procedure To Pay TDS Through Form 26QB

If you are wondering how to fill out form 26QB, here is the step-by-step guide:

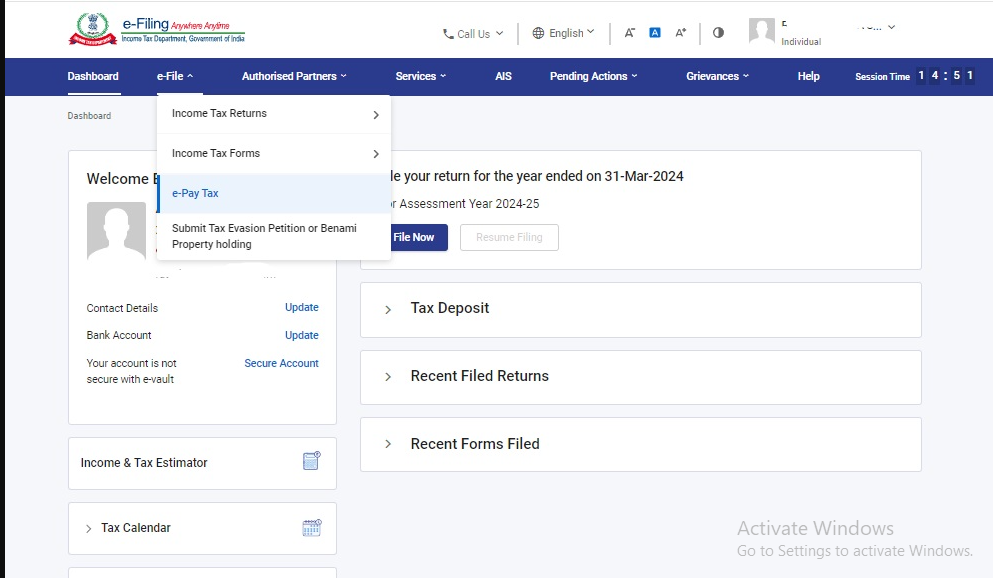

Step 1: Navigate to the official Income Tax Website and log in

Step 2: Navigate to the ‘E-file’ section, choose ‘e-pay Tax’, then click the ‘Proceed’ button for ’26QB(TDS on sale of property)’ in the ‘New payment’ section.

Step 3: You must fill three Pages by providing the necessary information.

Property details, Tax deposit details, the amount credited or paid, address details, and communication or contact details.

Buyer basic details

Seller basic details,

Step 4: On the next page, select your preferred payment mode. You can choose either of the two options – ” ‘Pay later’ or ” ‘Pay Now’ as per your convenience.

Step 5: Click ‘Paynow’ to pay the required TDS amount. After this, Form 26QB acknowledgement will be generated and can be downloaded.

Step 6: Once Form 26QB is processed, you can generate the TDS Certificate from the TRACES Portal by logging in as a Tax Payer.

INDTAX is now on WhatsApp!

How To Download Form 26QB?

To know the steps for form 26QB download, scroll down:

Step 1: Navigate to the official Income Tax Website and log in. Select on e-file > e-pay taxes.

Step 2: Select Payment history. If Form 26QB was already filed, then you will see an entry under the type of payment: TDS on Sale of Property (800). Under Action, you will get the option to download the receipt, statement of Form 26QB

Here’s a sample Form 26QB.

Penalty Charges Associated With Form 26QB

The table given below discusses the penalty charges and possible reasons related to Form 26QB:

| SL No. | Reason for Penalty | Penalty Charges |

| 1. | Delay in filing TDS | According to provisions of Section 234E, you have to pay a penalty charge of Rs.200 for each delayed day |

| 2. | If the TDS is subtracted but not paid to the government | A penalty of 1.5% interest per month on the non-remittance of TDS to the government |

| 3. | Non-deduction of TDS | A penalty of 1% interest on the amount not deducted for TDS |

| 4. | If the required statement is not submitted within the stipulated time | As per Section 271H, you are liable to pay a penalty ranging from Rs.10,000 to Rs.1 lakh. However, no penalty charges will be applicable if you pay TDS along with fees, interest and the required statement within a specific time. |

Final Word

Form 26QB is a challan cum return statement that is required to file for the deposit of TDS on the property. If you are a purchaser, filing this form within the stipulated date is imperative to avoid hefty penalty charges.