Under the Goods and Services Tax (GST) framework, multiple reforms have been introduced to streamline compliance and enhance tax reporting accuracy. One notable change is the requirement to include HSN (Harmonized System of Nomenclature) codes in GSTR-1, especially within Table 12. Beginning January 2025, the third phase of HSN validation will come into effect, further emphasizing precise HSN code reporting for businesses. This comprehensive article examines the latest updates, outlines the phase-wise rollout, and highlights the enhancements to HSN validation in Table 12 of GSTR-1.

Ready to File Your GST Returns Seamlessly? Let IndiFilings take care of your GST returns and HSN reporting. While we make sure your filings are correct and in compliance, you can concentrate on running your company.

Current Information: Phase-III Table-12 Implementation in GSTR-1 and GSTR-1A as of April 2025

The Phase-III modifications to Table-12 of GSTR-1 and GSTR-1A would be implemented starting with the April 2025 tax period, according to the GST Network (GSTN). The continuous phase-wise improvements made to expedite HSN code reporting include these modifications.

The following are the main updates in Phase-III:

Separate Reporting for B2B and B2C Supplies: Following the division of Table 12 into two separate sections, B2B and B2C, taxpayers are now allowed to submit the HSN-wise summary of supplies under each category independently.

HSN selection from the dropdown menu is required; manual HSN code entry will no longer be accepted. To ensure accuracy and consistency, taxpayers must instead choose the relevant HSN from a pre-established dropdown list.

Introduction to HSN Reporting in GSTR-1

Under the GST framework, HSN codes are assigned to goods and services for streamlined and precise tax collection. These codes help identify and categorize traded items, thereby enhancing the accuracy of GST filings. To further refine compliance, the government has made HSN code reporting mandatory in GSTR-1, which businesses file either monthly or quarterly, depending on their turnover.

Within GSTR-1, Table 12 serves as the dedicated section for providing HSN summary details. Here, taxpayers must specify HSN codes for goods and services they supplied during the relevant tax period. The exact requirements for HSN reporting are determined by a business’s Aggregate Annual Turnover (AATO), ensuring that each taxpayer follows guidelines tailored to their specific scale of operations.

Current Information: HSN code reporting is required in GSTR-1/1A starting with the January 2025 return.

Taxpayers are required to disclose at least four- or six-digit HSN codes in Table-12 of GSTR-1, based on their Aggregate Annual Turnover (AATO) in the previous fiscal year, in accordance with Notification No. 78/2020 – Central Tax, issued October 15, 2020. The GST Portal has chosen to implement these criteria gradually, with Phase 2 going into effect on November 1, 2022.

Phase 3 for reporting HSN codes in Table 12 of GSTR-1 and 1A will start with the January 2025 return period, continuing this staggered implementation.

Please find attached the official announcement regarding the reporting of HSN codes in Table 12 of GSTR-1/1A.

Phase-Wise Implementation of HSN Reporting

The government has introduced the HSN reporting mandate in phases to ensure a smooth transition and sufficient adaptation time for taxpayers. Below is a detailed overview of each phase:

Phase 1: Initial Phase (Pre-2020)

In the initial phase, HSN reporting was optional for small businesses with lower turnover and only required for businesses with higher turnover. However, this approach was later recognized as a significant gap in the GST reporting system, paving the way for the introduction of mandatory HSN reporting.

Phase 2: Mandatory HSN Reporting (Effective from 1st November 2022)

Applicability:

- Businesses with AATO (Aggregate Annual Turnover) exceeding ₹5 crore must report 6-digit HSN codes in Table 12 of GSTR-1.

- Businesses with AATO up to ₹5 crore must report 4-digit HSN codes.

Manual Entry:

- During this phase, manual entry of HSN codes or descriptions was permitted, but the GST Portal generated warnings or alerts if incorrect or manually entered HSN codes were detected.

- Despite these alerts, businesses could still file their GSTR-1 returns without being blocked by the system.

Phase 3: Enhanced HSN Reporting (Effective from January 2025)

The third phase of HSN reporting brings substantial changes and becomes effective from the January 2025 return period. Key highlights include:

For Businesses with AATO up to ₹5 Crore:

- Mandatory reporting of 4-digit HSN codes for both goods and services.

- Manual entry of HSN codes will no longer be allowed; taxpayers must select from a predefined drop-down list.

- A new field—“Description as per HSN Code”—will auto-populate based on the selected code.

For Businesses with AATO above ₹5 Crore:

- Mandatory reporting of 6-digit HSN codes for goods and services.

- Manual entry of HSN codes is also disallowed here; codes must be chosen from the drop-down list.

- Corresponding descriptions will auto-populate, aligning with the HSN code selected.

These measures are designed to minimize errors in HSN code reporting and enhance the overall accuracy of GST filings. By progressively tightening requirements over these three phases, the government aims to promote better compliance and more reliable data within the GST framework.

HSN Validation Mechanisms in Phase 3

Phase 3 of HSN reporting introduces validation checks that compare the values entered for both B2B (business-to-business) and B2C (business-to-consumer) transactions against the HSN data in Table 12 of GSTR-1. Below is an overview of how these validations operate:

B2B Supplies Validation

- The value of B2B supplies reported in various tables of GSTR-1—such as 4A, 4B, 6B, 6C, 8 (recipient registered), 9A, 9B (registered), 9C (registered), 15 (recipient registered), 15A (recipient registered)—will be cross-checked with the B2B figures in Table 12.

- This ensures the data for B2B transactionsis consistent and accurately reconciled throughout the return.

B2C Supplies Validation

- The value of B2C supplies reported in tables like 5A, 6A, 7A, 7B, 8 (recipient unregistered), 9A (export), 9A (B2CL), 9B (unregistered), 9C (unregistered), 10, 15 (recipient unregistered)and 15A (recipient unregistered) will be verified against B2C values in Table-12.

- This mechanism reduces discrepancies and improves accuracy in reporting B2C transactions.

B2C Supplies

The value of B2C supplies reported in tables 5A, 6A, 7A, 7B, 8 (recipient unregistered), 9A (export/B2CL), 9B (unregistered), 9C (unregistered), 10, 15 (recipient unregistered), 15A (recipient unregistered) will be verified against B2C values in Table-12.

Amendments in GST Returns

In cases where taxpayers amend their returns, only the differential value (the changed portion) will be taken into account for these validations.

Warning Mode for Mismatched Values

Initially, these validations are in warning mode:

- Taxpayers will see alert messages if there is a mismatch between the values reported in Table 12 and other tables of GSTR-1.

- Despite the warning, taxpayers can still proceed with filing their GSTR-1 returns.

Important: If B2B supplies are entered in other sections of GSTR-1, the B2B tab of Table-12 cannot be left blank.

Additional Enhancements in Table 12 of GSTR-1/1A

In addition to the mandatory HSN reporting and validations, Table-12 of GSTR-1/1A has been upgraded with new features to further streamline filing and improve user experience:

Bifurcation into B2B and B2C Tabs

- Separate Sections: Table-12 now includes two distinct tabs: “B2B Supplies” and “B2C Supplies.”

- Accuracy & Clarity: Taxpayers must enter HSN summary details in the appropriate tab, ensuring clear segregation of business-to-business (B2B) and business-to-consumer (B2C) transactions.

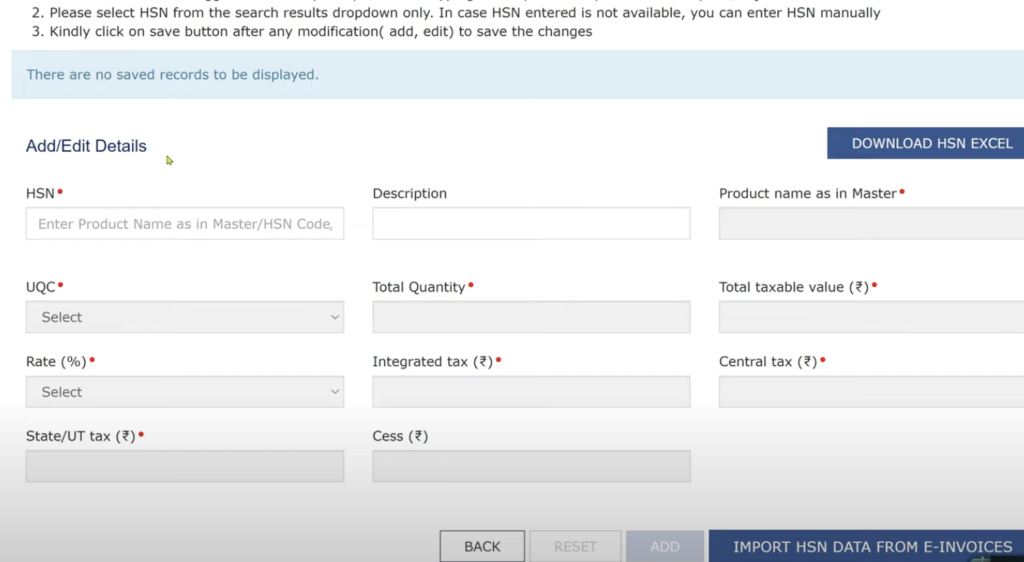

“Download HSN Codes List” Button

- Updated Codes in Excel: A new “Download HSN Codes List” button allows taxpayers to download an Excel file containing the most current HSN & SAC codes, along with their descriptions.

- Ease of Reference: This feature helps taxpayers verify they are selecting the correct codes for goods and services, reducing the likelihood of errors.

Searchable “Product Name as in My Master”

- Easy Look-Up: The “Product Name as in My Master” button is now searchable, enabling taxpayers to quickly find product descriptions they have stored in their HSN Master.

- Auto-Population: Once a product is selected, the HSN Code, Description as per HSN Code, UQC, and Quantity fields are auto-filled, minimizing manual entry.

- Optional Feature: Though not mandatory, using this functionality can save time and enhance accuracy in reporting.

Conclusion

Phase 3 of HSN reporting begins in January 2025, introducing stricter HSN code requirements and advanced validations in Table-12 of GSTR-1/1A. By removing manual entries, using dropdown menus for HSN codes, and enhancing validations for B2B and B2C supplies, the GST Portal aims to improve accuracy and transparency in filings. Taxpayers should update their systems, familiarize themselves with the new features, and promptly address any warnings to ensure smooth and compliant GST filings.

Use IndTAX Filings to Simplify the Filing of Your GST Return

Want to ensure smooth compliance with the most recent HSN reporting requirements and expedite the filing of your GST return? Get in touch with IndiaFilings right now. From choosing an HSN code to correctly validating your data, our knowledgeable staff will walk you through every step so you may submit with assurance and concentrate on expanding your company.

Start using INDTAX FILINGS right now to enjoy hassle-free GST compliance!

Concerning the Writer AREEB ABBASI

is a skilled writer who has a talent for distilling complex legal ideas into concise, useful guidance. His writings enable business owners by giving them the information they need to successfully launch and run their companies by navigating the complexity of business laws.

Last updated: April 14, 2025