Given the rising real estate prices in India, buying a home can be a difficult task without external financial assistance. Many prospective homeowners are increasingly turning to home loans to fund their dream property. It’s no wonder that housing finance saw a growth rate of over 16% in FY18.

For anyone planning to take a home loan, understanding the monthly EMI they need to pay is critical. Using a home loan EMI calculator provides an exact estimate, allowing borrowers to plan their finances more effectively.

How Can a Home Loan EMI Calculator Help You?

An Equated Monthly Instalment (EMI) is a fixed payment a borrower must make to the lender every month throughout the loan tenure. Calculating EMIs can be overwhelming for first-time borrowers, especially when dealing with large amounts like home loans. A home loan EMI calculator simplifies this process, providing accurate results instantly.

Manual EMI calculations are not only time-consuming but also prone to errors. With an online home loan EMI calculator, potential buyers can quickly and accurately determine their monthly EMIs, saving both time and effort.

The results provided by the calculator are essential for financial planning, ensuring there is no room for miscalculations. The calculator is specifically designed for home loans, meaning it calculates only for housing-related credit, unlike calculators designed for personal or other loan types.

Moreover, these calculators are available online for free and can be used an unlimited number of times. This allows users to test different loan amounts and tenures, helping them determine the best option for their financial capacity.

The Formula for Calculating Home Loan EMI

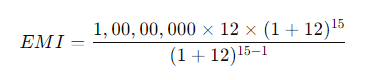

All online calculators follow a specific formula to calculate the home loan EMI. The formula is:EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1 + R)^N}{(1 + R)^{N-1}}EMI=(1+R)N−1P×R×(1+R)N

Where:

- P is the principal loan amount.

- R is the rate of interest.

- N is the loan tenure in months.

For instance, if a borrower takes a home loan of Rs. 1 crore for 15 years at an interest rate of 12%, the formula would be:

Using a home loan EMI calculator, the estimated EMI would be Rs. 1,10,108.

Breakdown of EMI Components

Every EMI consists of two main components – the principal repayment and the interest amount. In the initial years of loan repayment, the interest component is higher, while the principal amount is lower. Over time, as you repay the loan, the interest portion gradually decreases, and the principal repayment increases.

By using a home loan EMI calculator, you can gain a clearer understanding of how these components change over the course of the loan, enabling better financial planning for the future.

.