An overview of annual compliance for a private company highlights the necessity of maintaining its legal status through regular filings with the Ministry of Corporate Affairs (MCA). It is mandatory for every private company to file an annual return and audited financial reports with the MCA each fiscal year, regardless of turnover or business activity. This includes filing necessary documents with the Registrar of Companies (RoC), whether the company’s activities involve significant revenue or none at all. Failure to comply with these requirements can result in the company’s name being struck off the RoC register and can affect the competence of its directors. The timing for annual filings is based on the schedule of the Annual General Meeting (AGM), and non-compliance can lead to stringent actions by the MCA. Compliance requirements are categorized into Mandatory Compliances and Event-Based Compliances, each crucial for maintaining the company’s active status and legal standing.

Mandatory Annual Compliances

- First Board Meeting: The first board meeting should be held within 30 days of the company’s incorporation. Each director must receive a notice of the meeting at least seven days in advance.

- Subsequent Board Meetings: A minimum of four board meetings should be conducted each year, with no more than a 120-day gap between any two meetings.

- Filing of Acknowledgment of Interest by Directors: Directors must declare their interest or the interest of their relatives in any company, body corporate, or other organizations at the first board meeting of each financial year or whenever there are changes. This must be documented in Form MBP-1 and kept in the company’s records.

- First Auditor Appointment: The Board of Directors (BOD) must appoint the first auditor within 30 days of incorporation, who will continue until the completion of the first Annual General Meeting (AGM). Filing Form ADT-1 is not required for the first auditor.

- Subsequent Auditor Appointment: The BOD must appoint a new auditor at the first AGM, who will serve until the sixth AGM. Form ADT-1 must be filed with the Registrar of Companies (ROC) within 15 days of the appointment.

- Annual General Meeting (AGM): The company must hold its AGM in accordance with the statutory requirements and notify the appointment of auditors to the ROC.

- Filing of Annual Return (Form MGT-7): The Annual Return must be filed within 60 days of the AGM, covering the period from April 1 to March 31 of the financial year.

- Filing of Financial Statements (Form AOC-4): The company must file its Balance Sheet, Profit and Loss Account, and Director’s Report in Form AOC-4 within 30 days of the AGM.

- Statutory Audit of Accounts: The company must have its accounts audited by a qualified professional or Chartered Accountant at the end of the financial year. The auditor will provide an audit report and audited financial statements for filing with the Registrar.

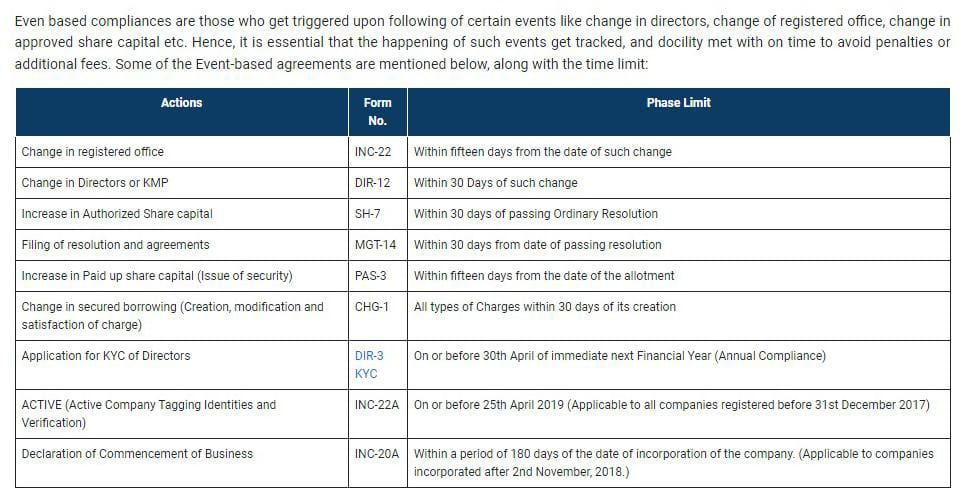

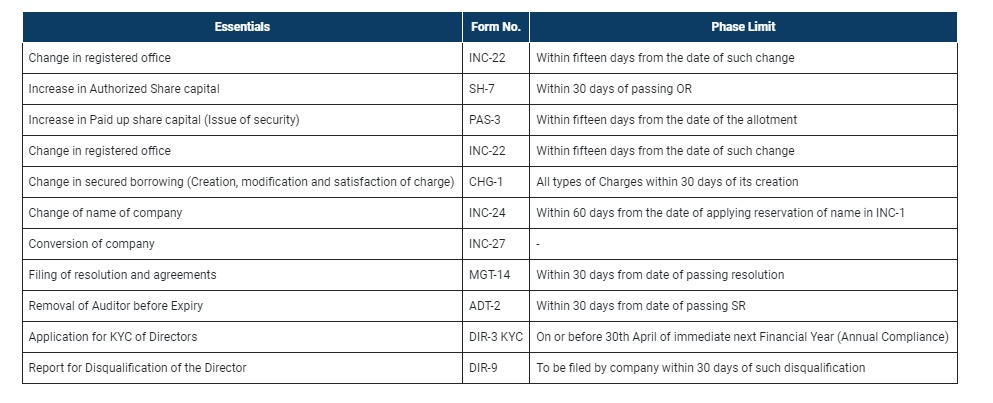

Event-Based Compliance

Stipulation of non compliance

Non-compliance with mandatory annual requirements for a private company can lead to significant consequences. Failure to adhere to regulatory deadlines for filing annual returns, financial statements, or conducting AGMs can result in penalties, fines, and legal actions. Persistent non-compliance may lead to the company being struck off the Registrar of Companies (RoC) register, and directors may face disqualification or other legal repercussions. The Ministry of Corporate Affairs (MCA) actively enforces compliance, making it crucial for companies to meet all statutory obligations to avoid these severe outcomes.

Benefits of Annual Compliance

Establishing a company’s credibility is crucial as adherence to legal requirements demonstrates reliability. Consistent annual return filings on the MCA portal reflect the company’s commitment to regulatory compliance, which is a key factor in gaining tenders, loan support, and other opportunities.

Attracting investors is another benefit. Investors seek detailed financial histories before making funding decisions. Regular compliance reports, available through the MCA portal, can make a company more appealing to investors by showing a track record of good governance and financial transparency. Maintaining an active status and avoiding penalties is essential. Failure to file returns on time can lead to the company being marked as defunct or removed from the RoC registry, with substantial penalties imposed. Since July 2018, a daily supplementary fee of ₹100 for delays has been applied, further emphasizing the importance of timely compliance

Documents Requires for Annual Filling of Company

- • Incorporation Certificate

- 1. PAN Card

- 2. Certificate of Incorporation and

- 3. MoA – AoA of Private Company

- . Audited Financial Statements

- . An independent auditor must audit financial Statements

- . Audit Report & Board Report

- • Independent auditor’s report and Board report must be concerned

- . DSC of Director

- . Accurate and active DSC of one of the directors must be provided and presented

Procedure for Private Limited Company Annual Compliance and Filing

At Professional Utilities, we handle your Private Limited Company’s annual compliance efficiently. Upon receiving your request, we will assign a skilled professional adept in business compliance to support you throughout the process. This dedicated resource will assist in managing all compliance activities and be available for consultations and guidance.

Our comprehensive support includes maintaining and preparing annual financial statements, managing the accounts, and ensuring timely filings. We will collect all necessary documents and complete the following compliance activities:

- Management of accounts and preparation of financial statements

- Filing of annual returns

- Conducting and documenting Annual General Meetings (AGMs)

- Organizing board meetings

- Preparing director reports

- Filing of annual forms and other required documentation

- Handling yearly forms and filings by directors

Additionally, we will file your company’s income tax return with the Registrar of Companies (RoC) and manage the accounts scrutiny. Our services also include drafting minutes of meetings, handling announcements, and maintaining the statutory register.

These steps ensure your Private Limited Company meets all requirements under the Companies Act 2013, maintaining compliance and operational efficiency.

Conclusion

Ensuring timely and accurate annual compliance is crucial for the smooth operation and legal standing of your Private Limited Company. At Professional Utilities, we provide comprehensive support to streamline this process, from managing financial statements and conducting AGMs to filing necessary forms and maintaining statutory registers. Our expert team is committed to helping you navigate compliance requirements efficiently, avoiding penalties, and enhancing your company’s credibility. By partnering with us, you can focus on growing your business while we handle the complexities of annual compliance and filing.